What are the surviving spouse rights in Georgia? Does the surviving spouse automatically inherit the entire decedent’s estate? Do they have to initiate inheritance proceedings? How much and what do the deceased’s children inherit? Can they be removed from the estate?

These are just a few of the questions we get every day from our clients. In this post, we will answer them to provide some basic information to help you properly handle the estate’s property and honor your loved one’s memory.

What Are the Surviving Spouse Rights in Georgia?

When a person dies, there are two situations:

- There is a valid last will or a testament stipulating how the decedent’s estate would be divided. If the will is probated and accepted by the probate court, then the surviving spouse is entitled to receive what was designated in the will. Years support may also affect the amount the surviving spouse will receive.

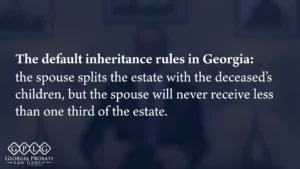

- When the decedent doesn’t have a will. Georgia’s default inheritance rules apply, according to which the spouse shares the estate with the deceased’s children but will never receive less than one-third of the estate.

However, you should know that only natural and adopted children (and not stepchildren) of the deceased count.

Georgia intestate succession

Intestate means the deceased did not have a valid testament or last will when they passed away. According to intestate succession laws, can occur the following situations:

a) The deceased was legally married at the time of passing and

- had no children. Then the spouse will receive the inheritance.

- had children. The spouse will receive no less than 1/3 of the entire estate, and the children will share the remaining 2/3.

You should know that a Year’s Support could change the inheritance amount, and it can be made on behalf of the surviving spouse or minor children to claim more than their share of the estate.

b) The deceased was not married and had children, then the children will receive the inheritance.

If one of the children died before the deceased and had children of their own, they would stand in their place to receive their portion.

c) If the deceased was unmarried and had no children, their parents are the next to receive.

If both deceased’s parents passed away before the decedent, then the late siblings are next in line of succession. If one or more siblings are dead and have children, their children will be in the succession line.

The default inheritance rules can be changed if the deceased has left a valid will. Therefore, this means the spouse’s inheritance will be determined by what the will says.

When a Husband Dies, What Is the Wife Entitled to in Georgia? Does a Spouse Automatically Inherit Everything?

It depends. If the deceased has a will and is probated and accepted by the probate court, the spouse will receive what has been designated in the will.

If the decedent doesn’t have a will, then the Georgia Intestate Succession rules apply.

Jointly Held Property. Is Georgia a Community Property State In Death?

No, Georgia is not a community property state in death.

Real estate titled Joint Tenants with Rights of Survivorship means that if one of the owners listed on the property passes away, the property is assumed to be 100% owned by the other owner on the deed without going through the probate proceedings.

Suppose the real estate does not explicitly state that it is owned as Joint Tenants with Rights of Survivorship. In that case, it is assumed to be held as Tenants in Common, and according to the Georgia inheritance law, it may need to go through the probate process to be appropriately transferred to heirs or beneficiaries.

When the bank account is a True Joint Account, it is primarily viewed as a non-probate asset and will belong to the remaining owner(s) after one owner has passed away.

Year’s Support in Georgia

There is a mandatory order of how the creditors must be paid, and one of the executor’s duties is to ensure that they are satisfied in the correct order.

According to Georgia law, creditors are prioritized in the distribution of estates before heirs or beneficiaries.

The list of creditors is from one to eight, meaning that the first creditor on the list must be paid first, and the eighth creditor must be paid last.

Creditor list

The first creditor on the list is Year’s Support – by a surviving spouse or a minor child against the estate, usually to help them ease their transition to a new life. Year’s Support provides financial relief to families and protects assets from other creditors’ claims. It can be beneficial if estate assets are insufficient to cover all debts or if the spouse still has minor children to raise.

The surviving spouse must submit a petition with the probate court within two years of the date of the deceased’s death. For minor children, it must be filed within two years of the date of the deceased’s death and before they turn 18.

If the claim for a Year’s Support covers the entire estate and the probate court accepts and approves it, the petitioner is entitled to the whole inheritance. In contrast, the other estate creditors and the heirs/beneficiaries (categorised last on the creditors’ list) will not receive anything.

If the surviving spouse files a petition, the creditors, heirs, and beneficiaries can contest it. A common objection is that the party disagrees with the petitioner receiving some or all of the requested amount.

Once someone files an objection, the court may set a hearing at a later date to determine the amount of money or property they should grant the petitioner.

However, mediation may occur to reach an agreement between all parties. If this is not possible, the case will go to a hearing, where the petitioner must prove the amount they requested.

After hearing all the evidence and testimony, the probate court will decide how much, if any, Year’s Support it will grant.

No elective share for surviving spouses in Georgia

In case of a disinheritance, in Georgia, we don’t have what in other states is known as an elective share – whereby a disinherited spouse can bring an action in probate court for the rightful share of the deceased’s estate.

Instead of elective share, we have Year’s Support in Georgia.

Estate Planning Considerations For Surviving Spouse Rights

Preparing for a property transfer starts while people are alive. It is essential to have a valid will and discuss each other’s estate plan with your spouse to understand each other’s wishes. This will reduce the stress and challenges of managing your spouse’s estate in the future.

The property information package should include the following:

- a copy of the will and any other succession documents.

- a list of all financial accounts.

- a list of all assets to which beneficiaries may be entitled.

- details of all your significant debts and assets.

Georgia Inheritance Laws

When your loved one dies, most probably, you’ll want to handle the deceased estate properly and honour their memory. With or without a will, the process can be complex and confusing.

When there is a will:

The will indicates how the deceased’s probate property should be divided, who should manage the estate, and sometimes, it may also provide special rules or considerations for how the property should be handled. It may also state who is entitled to be named guardian of a minor child if both parents die.

If it is valid, probate, and accepted by the probate court, the beneficiaries of the testament will inherit the designated shares once creditors have been satisfied.

When there is no will:

Official Code of Georgia Annotated (OCGA) is the Georgia law that determines who are heirs at law of a decedent (the person whose death necessitates the administration of his or her estate) and which rules apply.

How to Obtain the Surviving Spouse Rights?

To navigate Georgia probate court as a surviving spouse, in general, you have to complete the following steps:

File the necessary petition with the probate court to recognize the death and attempt to have a Personal Representative appointed over the estate to begin the probate process.

Publish a notice in the local newspaper, letting creditors and other parties know the estate is in probate.

Establish an estate bank account to hold any funds for the estate.

Inventory the deceased’s assets. Including bank accounts, real estate, and personal properties.

Settle debts. Use the estate assets to pay off any decedent’s debts (including medical bills, loans, and credit cards).

Distribute the remaining assets after paying off the debts. If there is a will, follow it. If not, Georgia’s probate laws dictate who gets what.

File the necessary tax returns for the deceased. Pay any taxes owed from the estate’s assets.

After settling debts and distributing assets, ask the court to close the estate. This ends the succession process.

During probate, the surviving spouse may be entitled to certain rights, including a year’s support and a share of the estate if there is no will.

Does Georgia Have an Inheritance Tax or Estate Tax?

Georgia has no inheritance tax.

Georgia’s estate tax is based on federal estate tax law, and if any estate tax is due, it should be paid by the estate representative before the assets are distributed.

Dying With a Will in Georgia

Although the deceased may have a will, it must still be probated to transfer his assets properly.

Dealing with the question related to the validity of a testament is one of the primary purposes of the probate court. To do that, the person filing the will must provide certain information to prove its authenticity.

If an heir objects to the will, the civil dispute process begins. It follows a hearing, where the court will hear evidence and determine whether the will is valid or not.

Dying Without a Will in Georgia

When the deceased person has no will, the matters will follow the intestate laws of Georgia. An estate administrator will be appointed to handle the property and ensure that all rights of the heirs are respected.

Disinheriting a Spouse in Georgia Inheritance Law

In Georgia, anyone can make a will, leaving their assets to anyone they choose. However, the surviving spouse can challenge the testament if they have a plausible reason (such as incapacity and undue influence) to consider it invalid.

If a surviving spouse has been disinherited, they could use the year’s support to receive a share of the estate.

At the same time, all the interested parties, such as heirs and creditors, would also have the possibility to challenge the year’s support request.

However, a surviving spouse will not be disinherited if there is no will.

Georgia’s Next of Kin Law

Understanding who the heirs are in a probate situation, with or without a will, is essential.

Suppose there is a will, but the direct heirs of the deceased are not mentioned as its beneficiaries. In that case, they will still need to be contacted to start the succession process and to have the opportunity to challenge the testament.

If there is no will stating particular beneficiaries of the property, the direct heirs of the deceased will also be beneficiaries of the inheritance.

Non-Probate Georgia Inheritances

Non-probate assets already have a designated beneficiary to receive the asset upon the owner’s death. As the decedent’s last will doesn’t govern them, these assets don’t have to go through probate.

The financial institution that holds the asset can pass it directly to the designated beneficiary.

Common examples of non-probate assets are life insurance policies with designated beneficiaries, 401K accounts with designated beneficiaries, and a bank account with a POD (Payable on Death) assigned to the account.

How Can You Give the Surviving Spouse Living Rights to a Home in Georgia?

An option is to establish a joint tenancy with the right of survivorship. In this arrangement, co-owners hold equal shares of the property. Upon one owner’s death, their share automatically transfers to the surviving owner(s), regardless of whether or not there’s a will.

A revocable living trust is another option you can consider. This estate planning tool allows you to place your property into a trust during your lifetime, with the ability to amend or revoke it as you wish. Upon your death, the property is passed directly to your designated beneficiaries without going through probate.

Surviving Spouse Rights on a Mortgage in Georgia

Several factors determine what happens to a deceased person’s mortgage and the surviving spouse’s rights.

Typically, if you inherit the house and are a co-borrower on the mortgage, you will also inherit the mortgage. As a rule, the only thing you should do in this case is to notify the creditor that your spouse has died.

The loan automatically becomes your responsibility unless the deceased has a mortgage life insurance policy. This particular type of life insurance policy pays the outstanding mortgage balance in full if a borrower dies.

When you inherit the house, you have a few options, but your name isn’t on the mortgage. Depending on your existing mortgage terms, home value and other circumstances, you may consider:

- refinancing the mortgage on your own account or with a co-signer.

- sell the house, and pay off the mortgage debt.

- stay in the house and take over the existing mortgage.

What’s Next?

The surviving spouse rights in Georgia are complex. If you have inheritance questions, we recommend consulting with a probate attorney who understands the process. This allows you to ensure that everything goes smoothly while avoiding legal issues. Contact our office at (770) 796-4271 if you need legal Support.

More information

Disclaimer These websites have not been reviewed by Georgia Probate Law Group and are not endorsed or even recommended by Georgia Probate Law Group. These websites are additional resources that you can use to further your general education on this topic.

Disclaimer: The information above is provided for general information only and should not be considered legal advice. Our probate attorneys provide legal advice to our clients after talking about the specific circumstances of the client’s situation. Our law firm cannot give you legal advice unless we understand your situation by talking with you. Please contact our law office to receive specific information about your situation.